Digiant has collaborated with S&P Global (IHS Markit), a leading market research agency in the world in their study on agri-food exports through e-commerce to China.

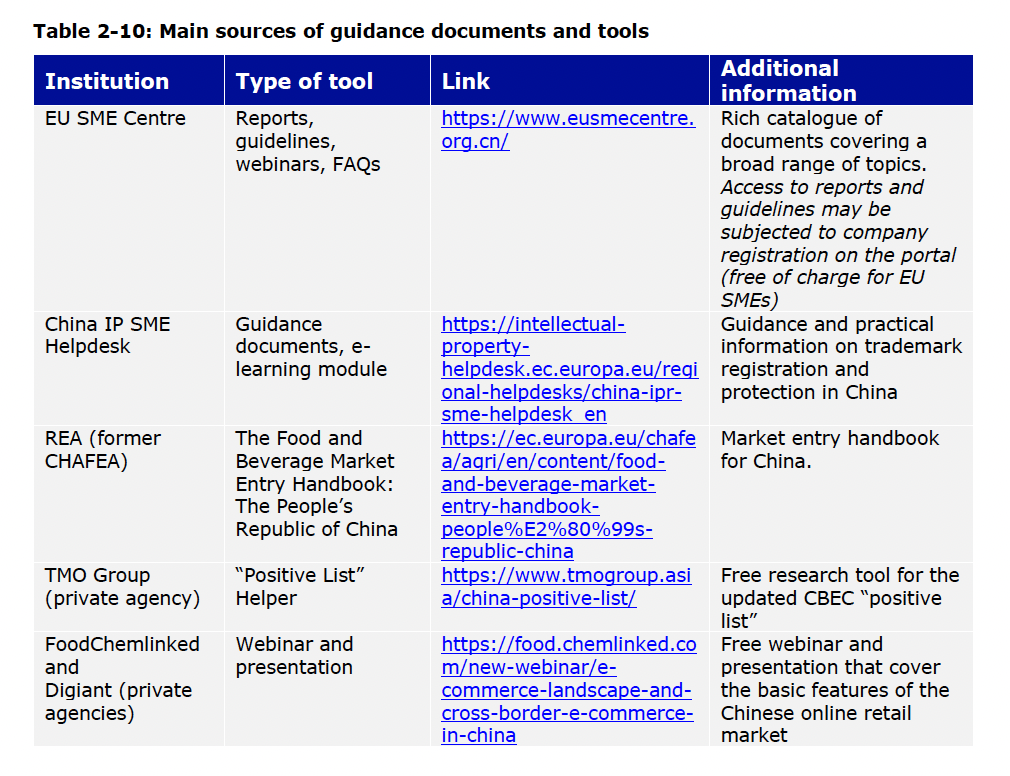

We are delighted to have collaborated in the study by sharing our insights on The main differences between general trade and Cross Border Ecommerce (CBEC), the Chinese online CBEC retail market, Logistics solutions for CBEC, Documentation required for CBEC and Trade Partners for Chinese online platforms.

China is the world’s largest e-commerce market with the agri-food segment estimated at EUR 82 billion in 2020. It is an important and expanding market for EU agri-food product exports, having grown at around 20 % per year over the last five years.

China is the world’s largest e-commerce market with the agri-food segment estimated at EUR 82 billion in 2020. It is an important and expanding market for EU agri-food product exports, having grown at around 20 % per year over the last five years.

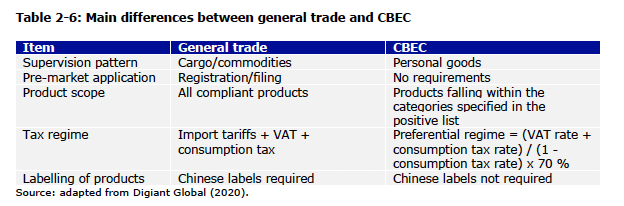

China has developed a specific cross-border e-commerce (CBEC) scheme simplifying import through e-commerce of certain products on the so-called positive list which covers about 400 agri-food products notably excluding most fresh products.

Products sold through this scheme pass through special CBEC platforms and have some advantages in terms of administrative requirements and retail price. However, due to a combination of the inability of certain products to use the scheme, a low awareness of the scheme among exporters and the fact that exporters may not actively and specifically target the e-commerce segment, EU agri-food exporters currently rely mostly on the general trading system for sales of their products through e-commerce, using the traditional customs process.

On the other hand, even if the products sold by e-commerce feature on the CBEC positive list, using the general trade system could be an advantage as products can subsequently be sold through any e-commerce platform or other channel in China; those imported through the CBEC scheme can only be sold through CBEC e-commerce platforms.

Below is a quick summary of the categories in which Digiant has collaborated for the study

In Conslusion

The Chinese CBEC scheme is an important specific driver for EU agri-food products sold through e-commerce as it provides opportunities for certain exporters. However, the socio-economic landscape is the most important driver: a structural food shortage, a growing middle class which increasingly demands higher quality and a trend towards western products generated by China’s Generation Z and Millennial consumers fuel demand for imported agri-food products sold through e-commerce. Nonetheless, it should be noted that even if China has a well-developed technological infrastructure for e-commerce, the internet and social media landscape in China is completely different from that in the west, with different platforms (e.g. WeChat, Little Red Book, Weibo) and other methods of using these platforms (e.g. livestreaming).

In this context, there are many considerations relevant for EU agri-food producers considering or already using e-commerce to export to China.

For a copy of the full report, please click here.

Comments are closed.

Recent Comments